Redefining the Purpose of Saving

For decades, traditional financial recommendations has leaned greatly on the concepts of frugality, postponed gratification, and aggressive conserving. From cutting out morning coffee to giving up trips, the message has actually been loud and clear: save currently, take pleasure in later. However as social values shift and people reassess what monetary wellness actually implies, a softer, a lot more mindful technique to cash is gaining traction. This is the essence of soft saving-- an emerging way of thinking that focuses much less on stockpiling cash and more on aligning financial choices with a meaningful, cheerful life.

Soft conserving doesn't indicate deserting obligation. It's not about overlooking your future or costs recklessly. Instead, it's regarding balance. It's regarding identifying that life is taking place now, and your cash needs to support your happiness, not simply your retirement account.

The Emotional Side of Money

Cash is usually considered as a numbers game, yet the method we make, invest, and save is deeply emotional. From youth experiences to social stress, our monetary habits are formed by greater than logic. Aggressive saving approaches, while efficient theoretically, can occasionally sustain anxiousness, shame, and a persistent concern of "not having sufficient."

Soft conserving invites us to think about exactly how we feel about our monetary options. Are you skipping supper with buddies since you're trying to stay with a stiff cost savings strategy? Are you postponing that trip you've fantasized regarding for many years because it doesn't appear "accountable?" Soft conserving difficulties these narratives by asking: what's the emotional expense of extreme saving?

Why Millennials and Gen Z Are Shifting Gears

The newer generations aren't necessarily gaining more, but they are reimagining what wide range appears like. After experiencing financial economic crises, housing situations, and now browsing post-pandemic truths, more youthful individuals are examining the knowledge of avoiding happiness for a later day that isn't guaranteed.

They're selecting experiences over possessions. They're prioritizing mental wellness, adaptable job, and everyday satisfaction. And they're doing it while still maintaining a sense of monetary obligation-- simply on their own terms. This shift has actually motivated even more people to reconsider what they actually want from their economic journey: comfort, not perfection.

Creating a Personal Framework for Soft Saving

To accept soft savings, start by recognizing your core values. What brings you joy? What expenses truly enrich your life? It could be an once a week supper with enjoyed ones, taking a trip to brand-new places, or buying a pastime that fuels your creative thinking. When you identify what matters most, conserving becomes less regarding limitations and even more regarding intentionality.

From there, take into consideration building a versatile spending plan. One that includes space for satisfaction and spontaneity. For instance, if you're considering home loans in Riverside, CA, you do not have to think of it as a sacrifice. It can be a step towards producing a life that really feels entire, where your space supports your dreams, not just your financial objectives.

Saving for the Life You Want-- Not Just the One You're Told to Want

There's no global plan for economic success. What benefit one person may not make sense for another. Standard guidance tends to promote big milestones: buying a residence, striking six figures in cost savings, and retiring early. But soft conserving concentrates on smaller, much more individual victories.

Maybe it's having the versatility to take a mental health day without economic tension. Possibly it's saying yes to a spontaneous weekend break escape with your friends. These minutes may not boost your total assets, but they can enhance your life in ways that numbers can't capture.

As more people uncover this strategy, they're additionally discovering that soft saving can exist together with wise preparation. It's not about abandoning financial savings objectives-- it has to do with redefining them. And for those navigating financial choices-- like investigating loans in Riverside, CA, the lens shifts. It's no longer simply a way to an end, yet part of a way of life that values both safety and security and satisfaction.

Letting Go of the "All or Nothing" Mindset

Among the largest obstacles in personal finance is the propensity to think in extremes. You're either saving every dime or you're failing. You're either settling all financial debt or you're behind. Soft saving introduces nuance. It claims you can save and invest. You can prepare for the future and reside in today.

For instance, lots of people really feel bewildered when selecting between traveling and paying for a loan. But what happens if you allocated modestly for this page both? By including happiness, you could in fact really feel more inspired and empowered to stay on track with your monetary goals.

Also selecting which financial institutions to work with can be guided by this softer mindset. With so many banks in California providing a vast array of services and products, it's no longer nearly rates of interest or charges-- it's also concerning discovering a fit for your way of life and values.

Soft Saving Is Still Smart Saving

Doubters may suggest that soft conserving is just a rebranding of investing much more openly. However that's not the instance. It's a calculated, psychological, and deeply human method to taking care of money in such a way that honors your present and your future. It shows you to construct a pillow without surrounding your joy. It assists you develop space in your life to prosper, not simply survive.

This doesn't indicate you'll never ever need to be disciplined or make sacrifices. It just indicates that when you do, you'll know why. Every dollar saved will have an objective, and every buck invested will feel lined up with what you value a lot of.

Financial health isn't a goal. It's a continuous process of knowing, changing, and expanding. And as you discover just how to make the most of your resources, soft saving provides a refreshing pointer: your money is a tool, not a test.

For more insights like this, be sure to check back frequently and follow along. There's more to discover as you proceed forming a life that's monetarily audio and mentally satisfying.

Tatyana Ali Then & Now!

Tatyana Ali Then & Now! Andrew Keegan Then & Now!

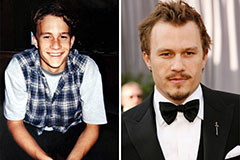

Andrew Keegan Then & Now! Heath Ledger Then & Now!

Heath Ledger Then & Now! Samantha Fox Then & Now!

Samantha Fox Then & Now! Teri Hatcher Then & Now!

Teri Hatcher Then & Now!